The IRS Form W-7, otherwise known as the Application for IRS Individual Taxpayer Identification Number, is a crucial document for nonresident aliens who are not eligible for a Social Security Number but need to file a federal tax return. With the vastness of digital bureaucracy, it's common for individuals to find the process of filing this form online quite daunting. Here, we aim to make the digital filing of the W7 form online as straightforward as possible.

Features of the W-7 Online Form

Switching to digital has become the new standard for the IRS. Colloquially known as the W-7 online application, it provides an efficient and paperless method for taxpayers. The convenience of filing online can make the processing faster and more efficient and is accessible 24/7, effectively removing the constraints of office hours.

Online W-7 Application & Possible Challenges

Despite its benefits, plenty of filers encounter difficulties when trying to file the W-7 online. The most common issues include system errors, confusion over the specific requirements and documentation needed, and concerns over the filing's security. While technical issues are mostly out of the taxpayer's control, the latter two problems can be solved by improving one's understanding of the form's requirements and ensuring the use of a secure network while submitting the form.

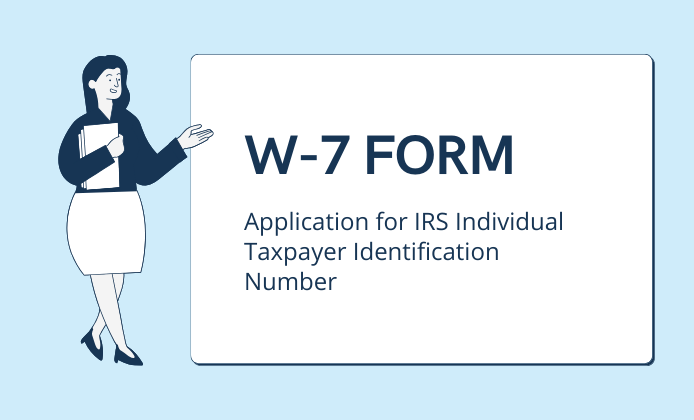

Fill Out the W-7 with Confidence: A Step-by-Step Guide

- Preparing the required documents

Before you begin your journey to fill out the W-7 online, make sure to gather all the needed documentation. These usually include proof of foreign status and identity. - Understanding the template

Before you start to fill out anything, take time to read the form and understand every question and how it applies to your situation. - Filling in the details

This is the stage where you input the necessary information into the W-7 online application. Take your time to fill out each section accurately. - Checking the application

After you've filled out the application, take the time to review everything. Ensure that all entries are accurate and mandatory sections have been filled out. - Submitting the form

Once you've performed a thorough check, it is time to submit the form. Make sure you're doing this on a secure network to protect your private details.

Taking these steps will ensure a seamless experience when it's time to file the W-7 online. Patience, understanding, and a keen eye for detail will see you through this often complicated but necessary task.

Printable W-7 Form

Printable W-7 Form

W-7 Online Application

W-7 Online Application