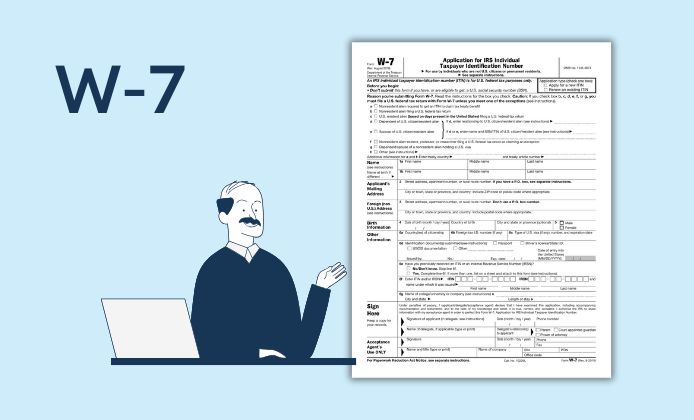

The W-7 form is an application submitted by individuals to the Internal Revenue Service (IRS) to apply for an Individual Taxpayer Identification Number (ITIN). The ITIN is crucial for those unable or not eligible to acquire a Social Security Number (SSN). A printable W7 form is conveniently available for free from our website, contributing towards making the taxpayers' lives easier.

This form is especially relevant for individuals who need to file a federal tax return but don't have an SSN. Besides this, non-resident aliens requiring a U.S. taxpayer identification number for tax purposes also utilize the W-7 printable form. The simple act of downloading, printing, and filling out the W-7 form can set these individuals on the path to fulfilling their financial responsibilities.

Guidelines for a Printable W7 Form Completing

While anyone can access the W-7 printable form, there are certain recommendations one should follow when completing the template. Below are a few key points to consider:

- Ensure the information provided in the template is accurate. The IRS verifies these details with the documents you provide.

- Indicate the proper reason why you are filing the application. This is found in the section labeled "Reason you're submitting Form W-7".

- Don't forget to sign and date the sample before submitting it to the IRS.

By paying heed to these points, applicants can ensure a smooth and error-free process with the IRS.

IRS Form W-7: Steering Clear from Common Errors

Even with the convenience offered by the printable W-7 application, applicants often make errors while completing the copy. To facilitate a smoother application process, make sure to:

- Avoid filling out the document with incorrect information. This remains the most common mistake.

- Don't disregard the necessity of accompanying identification documents. These serve as proof of your identity and foreign status.

- Lastly, disregarding the fields that don't apply to you is better than entering incorrect information.

By diligently adhering to these precautionary measures, you can avoid pitfalls and ensure the successful completion of your ITIN application process.

IRS W-7 Printable Form: Key Takeaways

Whether you're a resident or non-resident alien, having access to an IRS W-7 printable form in PDF can considerably simplify your tax filing process. Making this crucial form easily accessible online, the IRS furthers its mission to facilitate taxpayers in fulfilling their tax responsibilities. Download the application today, begin the process of obtaining your ITIN, and set yourself on the path to financial responsibility.

In summary, the printable W-7 form is an essential resource for individuals requiring an ITIN. By understanding its correct application and avoiding common mistakes, you can efficiently navigate your tax responsibilities with the IRS.

Printable W-7 Form

Printable W-7 Form

W-7 Online Application

W-7 Online Application