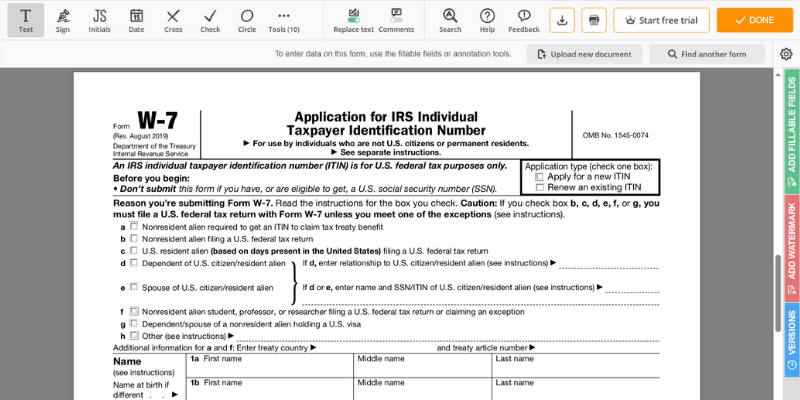

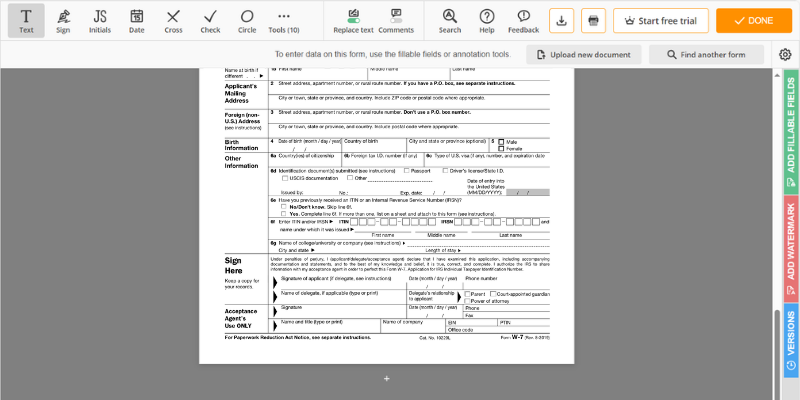

IRS Form W-7, also referred to as the ITIN application, is a necessary document for individuals who are not eligible for a Social Security Number but need to report their income for taxation purposes. The form establishes a US taxpaying identification decoded as the Individual Tax Identification Number (ITIN). Given this, the significance of the IRS W-7 ITIN application becomes obvious for particular groups, including certain foreign nationals and residency holders.

Our website, w7irsform.com, serves as an invaluable resource in this context, offering up-to-date IRS W7 form in PDF format along with a comprehensive set of instructions. It simplifies the task of filling out the form by breaking it into more manageable sections. Not only does the website provide IRS Form W-7 instructions, but it also includes practical examples demonstrating how to complete each section accurately. By fully utilizing our materials, taxpayers can smoothly navigate through the process, significantly reducing the potential for errors and thus ensuring accurate tax reporting.

The IRS W-7 Application: Eligible Applicants & Exceptions

Individuals who need to file Form W-7 to the IRS are those who are not eligible to have a Social Security Number (SSN) but earn income in the United States. Such persons can be dependents or spouses of U.S. citizens or nonresident aliens visa holders. If you fall into these categories, you will need to proceed with an IRS W7 application to comply with the current rules.

Notwithstanding, there are a few exceptions to this rule, enveloped within the following parameters:

- If you qualify for benefits stipulated by Sections 4, 5, or 6 of Revenue Procedure 2006-10, the form's filling and filing process is waived.

- Income tax treaty benefits may pose an exception, depending on your country of origin.

- If you only earn income effectively related to a U.S. trade or business, you are released from this filing obligation.

The W-7 IRS Form in PDF & Steps to Fill It Out

So, before moving forward to fill out IRS Form W-7, ensure you don't fall within these discretionary guidelines. By doing so, you will save yourself valuable time and maintain IRS compliance.

- Begin your process by locating the W-7 IRS form in PDF on the website. This version can be filled out directly within the browser, saving you the potential errors of handwriting.

- Ensure you have all necessary documents and identification available before starting to prevent unnecessary interruptions.

- Start by filling out your basic personal information, including name, address, and social security number.

- Go to the section requesting a foreign tax identification number. Here, those with a non-US tax identification number should include their information.

- Next, follow the provided IRS W7 instructions to correctly fill out the section on your reason for requesting the ITIN.

- Make sure to utilize the line-by-line explanations and tips provided in the instructions to keep you error-free.

- When the template is complete, review it carefully. Make sure all fields are filled in correctly and all information is present.

- Lastly, print the application, sign and date it, and then file the W7 form to the IRS for processing. Await their response, which should arrive within a few weeks.

Filing the W-7 Form to the IRS

Understanding the responsibilities associated with tax forms is crucial for financial management. Specifically, the W7 tax form is an essential document that many disregard. There is no specific due date to the W-7 form as it's primarily filed when a federal income tax return is due or when an individual can’t get a Social Security Number (SSN). Important dates to consider are usually related to the tax year or deadlines for specific tax-related obligations. Proper comprehension and timely filing of IRS Form W-7, Application for ITIN, can assist in creating an organized financial profile.

IRS Form W-7 Instructions (2023)

IRS Form W-7 Instructions (2023)

File W-7 ITIN Application

File W-7 ITIN Application

Fillable W7 Form (PDF)

Fillable W7 Form (PDF)

Printable W-7 Form

Printable W-7 Form

W-7 Online Application

W-7 Online Application